Solutions / BNPL

Seamless shopping just got safer

Control your risk and fraud management

Scalable portfolio management and alternative credit decisions for Buy Now Pay Later providers.

Automated merchant onboarding allows you to add new merchants without delays.

Smart portfolio management empowers Buy Now Pay Later providers to split their traffic into groups and manage them with ease.

Get secured against

Identity Fraud

Prevent fraudsters from accessing BNPL services with fake, stolen or synthetic identity that bypass KYC checks. Buy Now Pay Later providers can apply advanced data enrichment and linking analysis that works in the background without introducing extra steps and friction into the conversion process.

Denial of service

High value customers checking out with higher risk baskets are particularly prone to false declines, this leads to lost fees and significant frustration on both the merchant and consumer side. Fraugster gives Buy Now Pay Later providers access to a superior data pool that allows them to identify “good” transactions. Moreover, your and your merchants approve lists are integrated in the one dashboard.

Rising operational costs

Rapid growth requires scalable fraud prevention and compliance operations. This does not mean hiring an army of analysts to complete manual reviews. Fraugster helps Buy Now Pay Later providers to automate acceptance decisions and eliminate manual reviews, so you can focus on serving your most precious asset, your customers.

KPI

Improved

performance

+5% Approval rate

Risk Management +

Alternative Credit Decisions

Combine our products to:

Reduce costs and increase conversion rates

Real time score suggestions for members and for guest users without an account or accessible history. No denial of service for good customers with compromised external credit history and no more fees for denied transactions that hit a Buy Now Pay Later providers bottom line.

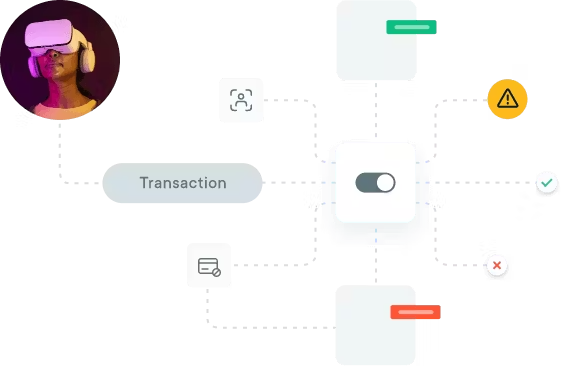

Leverage the power of AI

Manage your risk portfolio in one place. Performance monitoring, alerts, rules and rule simulations, data enrichment and linking analysis that keeps Buy Now Pay Later providers one step ahead of emerging fraud patterns.

Run smooth risk operations

Simulate your risk strategy before deploying it, and go live with confidence. Manual review allows Buy Now Pay Later providers to review transactions before shipping, and for tagging and learning. Alerts on sudden performance changes enabling you to take effective actions, fast.

"Fraugster's modular approach is the perfect complement to our inhouse machine learning platform. The flexible self-service rule engine allows our fraud analysts to quickly design, test and deploy anti-fraud rules directly in the real-time environment, resulting in greater revenue growth for our merchants."